Digital solutions have the potential to unlock new levels of efficiency, productivity, quality, and safety within water utilities. Yet, despite the upside, adoption of digital tech remains low. In this article, we consider some of the factors that have contributed to this digital divide, as well as potential actions for digital water solution providers in the US that could help accelerate adoption.

Why do some companies experience ‘hockey stick’ growth while others fall flat? At its simplest, the answer typically distils to how well the company is addressing an unmet need and how many (and how much) customers are willing to pay to fill that need. There are, however, many factors that influence these drivers. And in this article, we wanted to explore the current trajectory of digital technology providers targeting water utilities – and specifically, why so many companies are struggling to grow quickly.

First, let’s look at a few of the ‘needs’ that many companies address in this sector – for there’s no shortage of them. Chronic water challenges and the consequences unfolding due to rising global temperatures necessitate that utility leaders do more with less on every front. Digital solutions enable utilities to collect and make sense of the data they need to respond to these challenges. They create a pathway to greater efficiency, cost savings and productivity, and support utilities in meeting the expectations of customers who are accustomed to fast, personalized, on-demand online services.

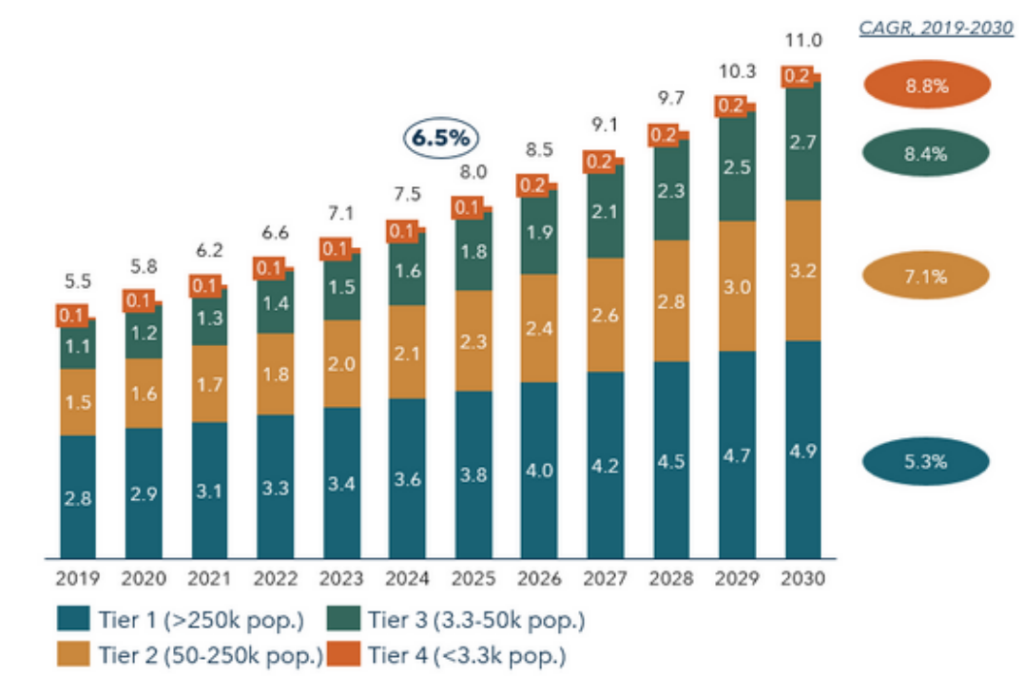

Next, looking at the potential customer base, there’s also a strong market opportunity. The digital utility solutions market was worth roughly $6 billion in the US alone in 2022. And many utilities, particularly at the smaller end of the market, are only just beginning their digital journey – a greenfield for technology providers. But while the pandemic upped the sense of urgency on adopting digital technologies, globally water utilities remain a digital laggard compared to other industries such as power, agriculture, mining. And despite the need and growing interest among their targets, many solution providers are struggling to convert them into

paying customers.

Source: Amane Analysis, Expert insights, GWI

What we’ve found is there are several hurdles that digital tech companies encounter in gaining market share within the water utilities sector. First, let’s look at some of the key hurdles that might be preventing digital solution providers from realizing exponential growth.

Fixing the engine while flying the plane

One key challenge for technology providers is whether the solution aligns with utility leaders’ top organizational priorities. Water utilities are responsible for the

world’s most precious resource and leaders are juggling significant challenges – from managing aging infrastructure to keeping pace with stringent regulations. Much of their focus is on executing the day-to-day tasks needed to ‘keep the water flowing’ – and digital transformation tends to rank lower on the priority list,

particularly for smaller Tier 3 and 4 utilities.

Furthermore, water utilities are historically known to be quite reactive and may lack a well-defined process to proactively implement changes – even if they would lead to improvements. For instance, a survey by the American Water Works Association (AWWA) showed that once a need for an infrastructure improvement had been identified, 60% of water utility leaders would take the next step when they suspect something is about to break or fail.

If your solution is not directly solving a critical pain point that is front-of-mind for utility leaders, providers should expect (and plan for) longer sales cycles.

Percentage of respondents who score a challenge as critical Source: AWWA 2021 “State of the Water Industry” Report, N = 3,021 %

Mini fiefdoms limit collaboration

We also find that many water utilities still work in silos – which adds further complexity and can further stymie the procurement process for solution providers. Outdated, disparate data and siloed people, budgets, and decision-making processes can limit collaboration and can prevent many utilities from making and

implementing strategic, data-based decisions.

Most utilities are still working with outdated SCADA and CMMS asset management systems that offer little-to-no integration with newer tools. Since most digital solutions need data to work, selling one tool involves talking to multiple stakeholders in various departments. Concerns over integration or the potential for obsolescence, as well as how to assess which of the 1,400+ digital tools out there today is the right choice – prevents leaders from signing on the dotted line.

Overcoming workforce challenges

As baby boomers edge closer to retirement, many industries are also grappling with how to manage the impact on their workforce. Water utilities today may have fewer workers to replace their aging workforce and operational expertise can be lost. Leaders often expect to lean on digital solutions to close the gap and enable newer staff to function at a similar level with less operational expertise. But when experienced decision-makers are not as accustomed to leveraging digital tools, there can be a disconnect in how tech providers communicate their value proposition and establish a clear business case for their solution.

Changing tack

These are just a few of the challenges that can grind the sales cycle to a halt – which, in turn, delivers a blow to technology providers’ unit economics. Lengthy sales cycles drain resources and over time, customer acquisition costs simply become much too high compared to the customers’ lifetime value. Slowly, but surely, the digital divide widens.

Source: Amane Analysis, Bluefield 2020 report “Water Industry 4.0: U.S. & Canada, Digital Water Market Forecast, 2019-2030”

The reality is that there are already hundreds of digital solution providers building great products and services with the potential to make a real, significant impact on water utilities’ operations, customer experience, and bottom line. The challenge for solution providers, therefore, is getting the right product, to the right customer segment, at the right price point – essentially, nailing your go-to-market (GtM) strategy.

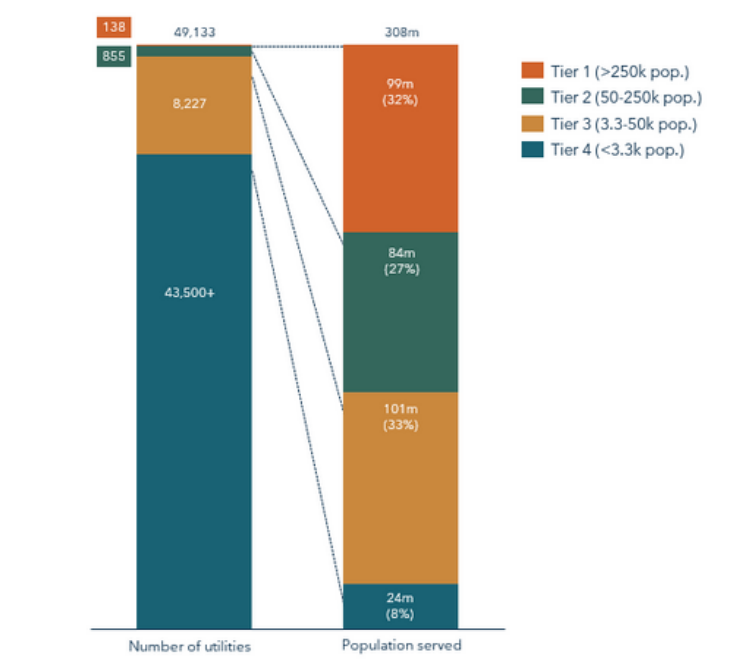

The US water utility market is large and fragmented, with approximately 50,000 water utilities. Around 2% would be considered ‘Tier 1’ and ‘Tier 2’, according to the size of the population they serve, but ~40% of the population is served by 40,000+ Tier 3 and Tier 4 utilities. Strategic priorities, leadership bandwidth and attitudes towards digital solutions vary greatly across these tiers. In general, Tier 1 and Tier 2 utilities have adopted more digital solutions due to their bigger size and availability of funds, whereas Tier 3 and Tier 4 utilities are typically at the beginning of their technology transformation. What we’ve found from our conversations with technology companies, however, is that many lack a clear picture of their ‘ideal’ customer.

Many are designing products, services and features to appeal to Tier 1 and 2 utilities – the coveted ‘whale’ customers that large, established tech players are also

targeting with comprehensive smart water platforms at enterprise price points. New entrants find it difficult to gain a foothold in this crowded and sophisticated market – and even harder to maintain a high margin.

On the other hand, there is abundant ‘white space’ to cater to Tier 3 and 4 utilities – albeit with a simpler and more cost-effective product. We’ve yet to see many companies hitting this market effectively but it could offer tech providers the potential to scale faster – perhaps by pitching more agile and streamlined ‘as a service’ pricing models and products or by leveraging channel partnerships that enable access to a greater number of Tier 3 and 4 utilities.

However, the onus isn’t solely on technology providers. Water utility leaders cannot afford to ignore the value that digital solutions can provide. Rising to the challenges ahead demands agile and data-informed decision-making. Digital is no longer a ‘nice to have’ and leaders must be proactive in exploring and considering

the solutions that are right for them. Greater cooperation among utilities, such as in sharing the results of pilot programs or agreeing to parameters through which results can be validated and acted upon with more speed, would go a long way in not only accelerating digital adoption, but also improving efficiency and driving costs savings across the board.