Radhika Mehrotra, Associate Director, Capital Markets at CDP

New government regulations are expanding efforts to protect water resources and improve resilience, but given the scope and increasing severity of water risk, it’s clear that strong private sector leadership is critical to accelerating action and scaling impact. CDP operates a global disclosure system to help investors, companies, cities, states, and regions manage their environmental impacts; promoting greater transparency and accountability.

We spoke with Radhika Mehrotra, Associate Director, Capital Markets at CDP about changing attitudes toward water risk, how businesses are striving to get a handle on their risks, and key drivers for action in the year ahead.

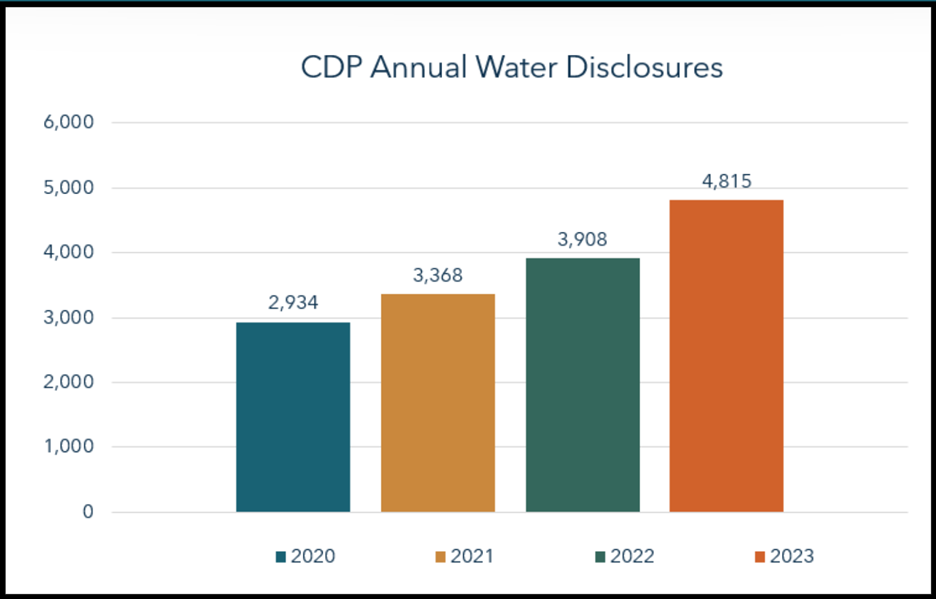

Amane: CDP’s latest Global Water Report (2022) noted an 85% increase in disclosure of private sector water data over the last five years. What role have investors been playing in encouraging further disclosure from across the private sector?

Ms. Mehrotra: Investor interest in water security has expanded, reflected in part, by the private sector call-to-action during the 2023 UN Water Conference, the growing focus on nature-related impacts and dependencies, and its role in meeting net zero ambitions.

Disclosure numbers are also continuing to grow. In 2023, a little over 4,800 companies disclosed water-related data through CDP, including 43% of the FTSE 100 and 41% of the S&P 500.

Source: CDP

Investor intervention ranges from direct engagement to financial innovations through sustainability-linked loans. In 2022, CDP’s Non-Disclosure Campaign, through which financial institutions can directly engage with non-disclosing companies on providing transparency through CDP’s water disclosure, saw a 50% increase in companies engaged.

Amane: What types of data are proving to be the most useful to investors in assessing water risk in investment opportunities?

Amane: What types of data are proving to be the most useful to investors in assessing water risk in investment opportunities?

Ms. Mehotra: The CDP questionnaire takes a comprehensive view of corporate water management across risk exposure, water-related targets, governance and strategic integration and water-related opportunities. The companies that we engage with are identified based on a materiality assessment that ranks industrial activities according to their potential impact on water quantity and quality. Investors that are at early stages of building their awareness use this assessment to identify priority sectors and companies for more targeted engagement and analysis.

For a deeper company and sector analysis, investors typically look at a range of quantitative and qualitative indicators to assess companies’ resiliency – primarily water accounting metrics such as withdrawals including facility level disclosures, localized water risk assessments, and water-related opportunities across the business. Financial products linked to water efficiency are also emerging. In 2022, Spanish Power Utility company Iberdola signed a sustainable credit facility for €2.5 billion through a syndicated loan led by BBVA. Two sustainability criteria assigned for this loan included a) Iberdola meeting its reduction targets on water consumption; and b) disclosing its water strategy and metrics annually through CDP while maintaining its evaluation score.

Amane: What’s the relationship between disclosure and companies acting on water?

Ms. Mehotra: CDP’s best practice questionnaires and standardized annual disclosure process build discipline and accountability. The insights from the annual dataset enable not only investors but also companies themselves to benchmark against their peers and monitor their progress.

Ms. Mehotra: CDP’s best practice questionnaires and standardized annual disclosure process build discipline and accountability. The insights from the annual dataset enable not only investors but also companies themselves to benchmark against their peers and monitor their progress.

From our 2022 dataset we can already see growing ambition – 58% of companies reported that they are maintaining or reducing their water withdrawals and 63% completed a water related risk assessment. This is also aiding corporate decision making and financial benefits with up to US$79 billion of investment identified to reduce water risks.

For instance, in 2022, Nissan Motor Corporation identified water related financial risk of US$190 million from water stress at specific facilities in Mexico and India. The company set and met targets to reduce water withdrawals by 23% per vehicle produced that prompted investments in wastewater recycling and rainwater harvesting, which also contributed to lower annual water bills of approximately US$4 million per year.

Amane: What tactics are you seeing corporates adopt to improve water efficiency, reduce pollution or to better integrate water into their strategy?

Ms. Mehotra: Improving water efficiency in both processes and products is the most common business opportunity, identified by 53% of companies across all sectors in 2022. This is driven by consumer expectations, regulatory oversight and business resiliency in the face of extreme weather events.

Ms. Mehotra: Improving water efficiency in both processes and products is the most common business opportunity, identified by 53% of companies across all sectors in 2022. This is driven by consumer expectations, regulatory oversight and business resiliency in the face of extreme weather events.

For example, Fujifilm is leveraging technological innovations to expand into water filtration using their ion-exchange membranes that are designed to contribute to the treatment of 35 million tons of water per year by 2030.

L’Oreal recognizes consumer’s preferences as a key driver of product innovation such as their ‘Waterless’ program designed to reduce the end users’ water footprint by 25%. The company is also developing labels that carry the environmental and social impacts of their products, such as water stress and ecotoxicity. Water-efficiency labels are expected to be introduced in some markets such as the U.K. by 2025 to help drive down water-related costs.

Amane: Many businesses tend to limit their water strategy by focusing solely on their internal operations. Do you see a need for more businesses to think ‘beyond the fence’ and work more collaboratively with external stakeholders on water issues?

Ms. Mehotra: Absolutely. Companies are beginning to look more outwardly at water strategy, particularly in two specific areas. First, companies are increasingly aware that the health of the river basin is synonymous with the health of their business, and that collaborating with others who rely on river basins may be the most efficient and effective means by which to achieve positive change. This is also acknowledged in the TNFD recommendations on stakeholder engagement and Science Based Targets for Nature guidance.

Ms. Mehotra: Absolutely. Companies are beginning to look more outwardly at water strategy, particularly in two specific areas. First, companies are increasingly aware that the health of the river basin is synonymous with the health of their business, and that collaborating with others who rely on river basins may be the most efficient and effective means by which to achieve positive change. This is also acknowledged in the TNFD recommendations on stakeholder engagement and Science Based Targets for Nature guidance.

Second, from a supply chain perspective, companies are realizing that it is in the early stages of the value chain where most impacts, dependencies and risks lie. Early analysis from CDP’s 2023 Water dataset indicates that only half of the companies included their supply chains in water risk assessments. The bottom line is that enhanced collaboration between companies, supply chains and local actors including indigenous peoples, smallholders and other local communities, will be critical for securing water access, reducing water security risk, enhancing reputation and contributing to wider environmental and social goals.

Amane: From severe heat and drought conditions to historic flooding, 2023 was a harsh reminder of the ways in which water can and will continue to impact businesses. What are some of the more positive headlines or milestones that give you hope for the future?

Ms. Mehotra: There were several market signals that reinforced the mainstreaming of water management. Some of these include the 2023 UN Water Conference, where for the first time in 46 years, Heads of State met to discuss international water policy. Also, water was included on the official agenda at COP27 for the first time.

In the financial sector, we saw the Network for Greening the Financial System (NGFS) acknowledge and make recommendations on nature related economic and financial risks, and the launch of the TNFD framework – both of which are valuable to further drive integration of water security within risk management.

Amane: What are some of the key drivers or influencing factors you’re keeping an eye on as we move into 2024?

Ms. Mehotra: 2024 has many firsts – the TNFD framework is being driven by companies and financial institutions and will galvanize water, deforestation, biodiversity, ocean health disclosures and support the transition to net zero. Also, the Corporate Sustainability Reporting Directive (CSRD) comes into effect in Europe requiring disclosure on climate change as well as water, biodiversity and circular economy.

We are excited to work with our stakeholders on streamlining these disclosures through the CDP questionnaire to further build on our water and deforestation programs. And, of course, please keep an eye out for the CDP 2024 Global Water Report, due out this Spring.