Investor interest in the water sector continues to grow, but 2023 saw a drop in the total number of water deals, and fierce competition with high valuations for the ones that were on the table. In this article, we’ll look at some of the reasons behind this competition and highlight where opportunities can be found in the year ahead.

In 2023, the M&A market was significantly hindered by recession concerns, the rising cost of capital, and general economic uncertainty. While the overall number of water deals declined significantly compared to previous years, we still saw circa 300 transactions through October of this year, likely buoyed by a growing demand for environmental, social, and governance (ESG) initiatives and the availability of ‘dry powder’ investment capital. Several mega-deals were closed in 2023 – most notably the acquisition of Evoqua by Xylem in an all-stock transaction that reflected an implied enterprise value of approximately $7.5 billion. The merger aims to address global water challenges by combining Xylem’s expertise in water solutions with Evoqua’s advanced treatment capabilities.

In Europe, Veolia continued to divest part of its activities as part of the Suez acquisition agreement, with Italgas acquiring its interests in long-term concession companies running water services in Lazio, Campania, and Sicily for more than €100m. Moreover, Veolia sold SADE, its subsidiary specialized in the construction and rehabilitation of water and infrastructure networks.

Whether seeking to invest in corporates or operating infrastructure assets, strong investor appetite for the water sector translated into fierce competition in 2023, particularly in more mature markets such as the United States of Western Europe, as many investors focus more on OECD countries.

Particularly for infrastructure assets, we noticed that the attractiveness of opportunities, coupled with the significant availability of capital to be invested, and an illiquid secondary market resulted in a shortage of opportunities and higher valuations across the board.

Let’s look at a few reasons behind this trend and explore the potential implications for investors as we move into 2024, with a specific focus on infrastructure assets.

The competition heats up

One of the factors driving increased competition to invest in infrastructure assets is that they are appealing to a wide group of investors. They yield long term predictable cash flows, are a natural hedge against inflation, and tick many of the ESG criteria asset managers increasingly need to meet – especially if the assets can be linked to a more efficient use of resources (e.g. leakage reduction or treated wastewater reuse).

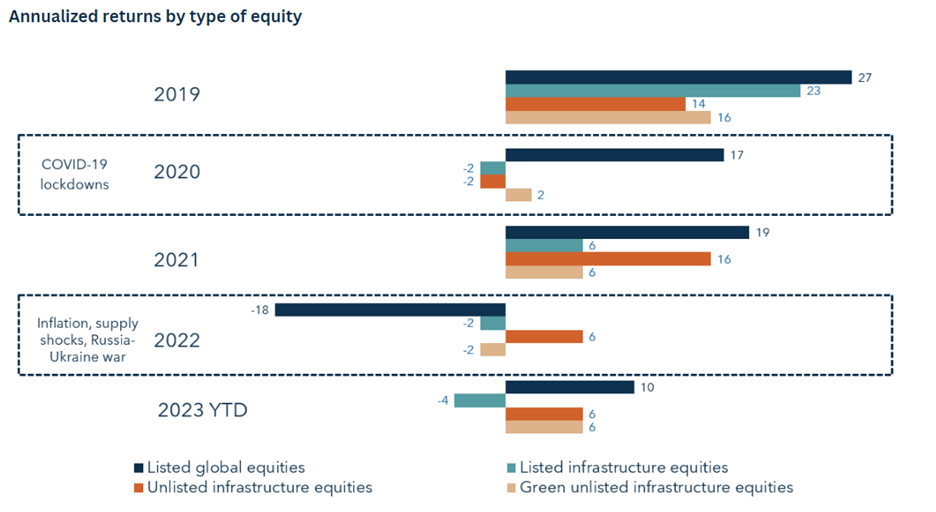

And while they might not be the star performers in terms of ROI, infrastructure assets are far less affected by global shocks such as COVID-19, rapid inflation or energy and supply chain disruptions caused by the Russia-Ukraine war. In particular, unlisted infrastructure equities provide better downside protection and present risk-return characteristics similar to bonds. In 2022, listed equities overall provided negative returns of -18% while unlisted infrastructure equities still provided a positive return of 6% (See chart).

Source: Global Infrastructure HubThe length of the investment cycle within water infrastructure assets has also reduced secondary market opportunities and increased investor competition. Owners tend to hold on to their assets and the secondary market in water is far less liquid than for other types of infrastructures (such as energy). Strategic corporate investors often remain for the full contract term and will typically have a role in the operation and maintenance of the facilities; whilst financial investors will generally rotate after 7 to 10 years (depending on their fund life span). These ‘holds’ limit the volume of activity that can take place in any given year.

Implications for the year ahead

Amidst these conditions, it is not surprising that owners have increasingly begun to organize a competitive process to drive up valuations. As a result, we’ve seen fewer successful bilateral transactions across the market, the exception being when there is a strong strategic rationale for both parties to reach an agreement. For instance, when a buyer brings additional technical or operational expertise or access to new markets, and the transaction allows both sides to leverage synergies and leads to a broader long-term partnership between the buyer and the seller.

Another consequence of this shortage of opportunities is that investors are stretching the definition of infrastructure assets to include anything with a somewhat long-term, predictable revenue stream – even if the opportunity is mostly services-based rather than asset-based. Overall, these dynamics naturally result in higher valuations, especially in more mature markets where the regulatory and economic environment are stable but the opportunities very few. This is typically seen in the contracted O&M market in the United States, where any operator being put up for sale will trigger a bidding frenzy, especially if they are of scale. Examples include New Mountain Capital’s acquisitions of Inframark in 2020 and ESG in 2021 at valuations of c. 13x and c. 15x EBITDA respectively.

Finding new investment opportunities in 2024 and beyond

In this competitive and challenging market, new investment opportunities are more likely to be found resulting from innovative business models and clever partnerships between strategics and financial investors. For instance, most single water assets are small to medium in size, as it’s a very localized and fragmented sector. To reach an attractive scale, asset managers are increasingly looking for platforms they can grow; bundling small assets together and deploying more CAPEX over time. This is an opportunity for strategics to create innovative business models that allow them to tap this available funding market and focus on their core expertise.

One could, for example, imagine a platform to finance add-ons to existing wastewater treatment plants in order to upgrade them and allow the treated wastewater to be reused. The return on investment could come in the form of additional revenues generated by the sale of the treated effluents. Another opportunity could be financing CAPEX to reduce leaks in water distribution networks and getting a return by sharing the revenues from the additional volumes of water sold to end users.

This can result in win-win opportunities for both strategics and financial investors, allowing to meet challenges and evolutions in the water sector (e.g. more stringent regulations requiring higher capex).